Business Insurance in and around Louisville

Researching coverage for your business? Search no further than State Farm agent Tracy Blair Haus!

Cover all the bases for your small business

Business Insurance At A Great Price!

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Tracy Blair Haus help you learn about great business insurance.

Researching coverage for your business? Search no further than State Farm agent Tracy Blair Haus!

Cover all the bases for your small business

Protect Your Business With State Farm

If you're looking for a business policy that can help cover computers, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

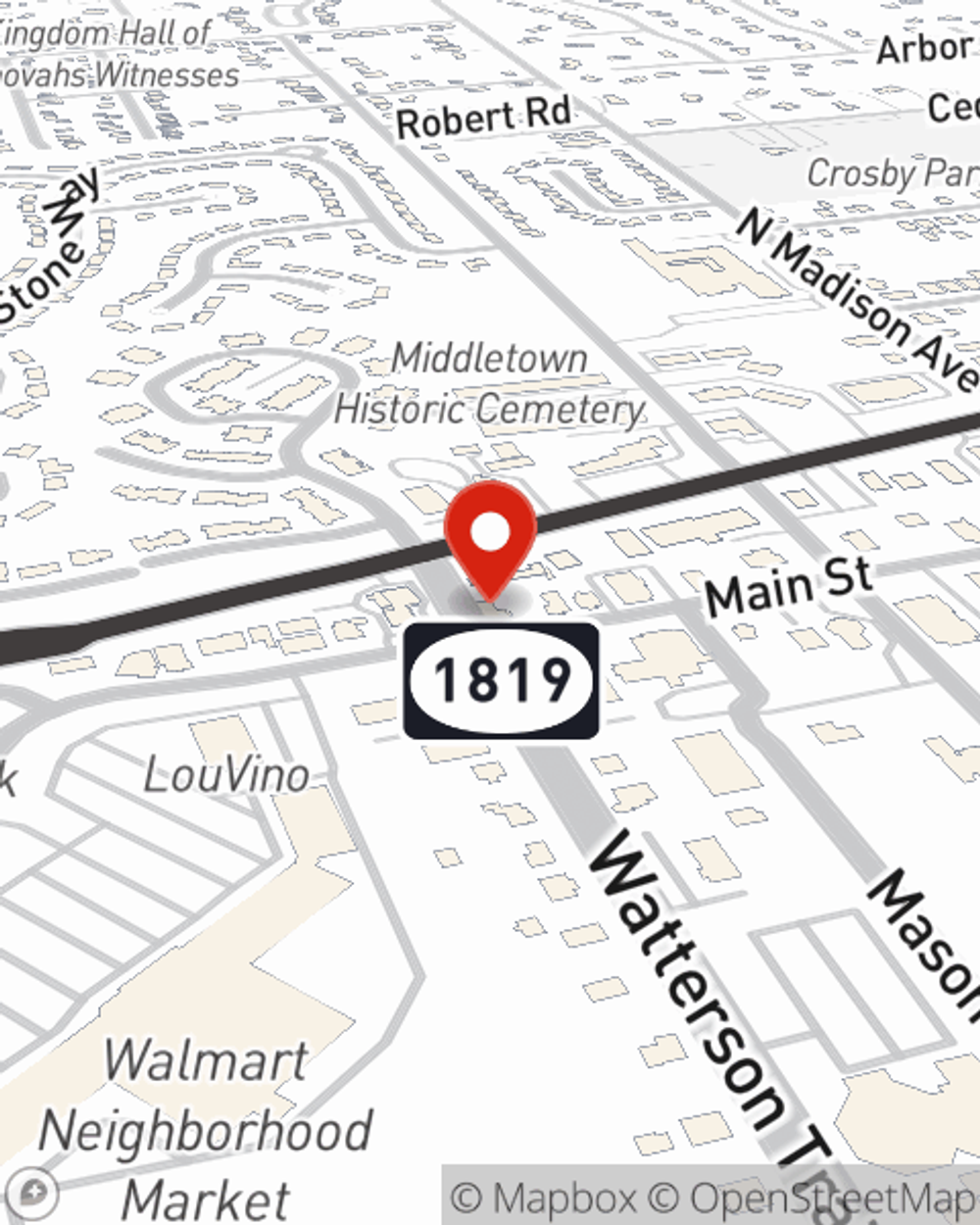

Contact State Farm agent Tracy Blair Haus today to find out how one of the leading providers of small business insurance can ease your business worries here in Louisville, KY.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Tracy Blair Haus

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.